Investment Management

Extreme events such as the “Financial Crisis” and qualitative factors such as emotions and the influence of the internet/media add to the complexities associated with deriving capital market expectations. It is our job to address these complex issues and to simplify them when working for our clients.

The Process

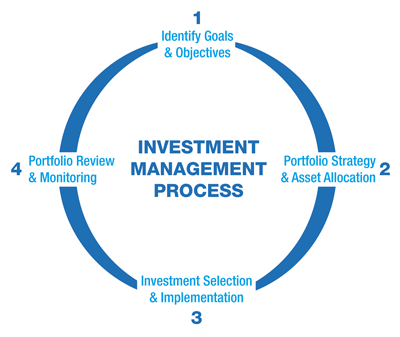

The Investment Process is comprised of the following steps:

1. Identifying a client’s objectives/goals

2. Determining a portfolio strategy/asset allocation

3. Investment selection/implementation

4. Portfolio review/monitoring

The various steps appear to be simple but the continuous aspect of the process is where the challenge lies. How we differentiate ourselves from other firms lies in how we follow through on the investment process. It is extremely important for our consultants to stay in touch with clients to update their objectives/goals and to constantly monitor capital market expectations to see how all variables will impact portfolio strategies moving forward.

Financial Planning

Recent events over the past decade have exposed weaknesses within the typical financial plan. Knowing that past market volatility will be experienced in the future, we believe that financial plans must be reviewed at least annually to account for any impact that capital markets may have on projections.

The Process

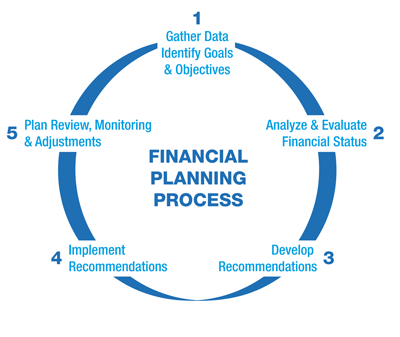

The Planning Process is comprised of the following steps:

1. Gathering client data, including identifying a client’s objectives/goals

2. Analyzing and evaluating a client’s financial status

3. Developing and offering financial planning recommendations

4. Implementing the financial planning recommendations

5. Financial plan review/monitoring/adjustments

Each of these steps is critical to the financial planning process, but no more than the continuous review and adjustments to the plan recommendations. To make this process manageable and sustainable, we often utilize a secure “client portal” which is an interactive tool providing access to real time data from various financial institutions in building and updating a client’s overall financial snapshot. This forms the basis in an ongoing financial planning strategy which is treated as a “living, breathing document” that has the flexibility to be updated as each client’s situation changes.

Trust Investment Management Services

Team Approach:

Combining the investment management services of EIP, LLC and the strength of an outside trust company. We believe that our model allows us to do what we do best – manage your trust investments, and allows a trust company to do what they do best – provide trust administration.

The size of EIP, LLC is a testament to its focus on client relationships and the experience of our portfolio consultants brings a vast amount of knowledge to the table. Our personal approach to working with clients is a priority in our selection process of an outside trust company. Financial strength is also a must when selecting a partner to fulfill the role as corporate trustee.

Eliminating Conflicts of Interest:

No proprietary funds – We do not have any proprietary investment products within our trust offerings.

Trust Companies are reluctant to fire themselves as investment managers – The trust company would not handle the management of the trust investments, therefore, this issue would not arise.

Allows a Trust Company to fulfill its fiduciary duties objectively – Without any proprietary products and knowing that we are responsible for investment decisions, the selected trust company can objectively analyze the trust investment with regards to quality and suitability, all in an objective manner so that clients’ best interests are at the forefront.

Accountability at forefront due to checks and balances – EIP, LLC and the selected trust company are partners, but exist as two distinct entities whose duties are to the client first.

Managing Your Legacy:

Many challenges exist with the management of trust assets in today’s market environment. Unprecedented volatility has changed the landscape considerably for investment professionals where a new “normal” has been established.

Income Beneficiaries vs. Remainders-men – Balancing income needs against growth objectives is a daunting task. With interest rates at historical lows, the tendency may be to increase the allocation to fixed-income securities to provide income to beneficiaries at the expense of long-term growth for the remainders-men named in the trust.

Total Return Unitrust Approach – When income needs cannot be met by making changes within allocation parameters, applying the Delaware Uniform Principal and Income Act may be a viable option if allowed by trust document. Converting from an income only trust to a total return unitrust provides the ability to access returns attributed to equities when making distributions.

Distributions and Capital Market Expectations – Even though a Total Return Unitrust approach allows trusts to be managed with a focus on both capital appreciation & income, investment professionals must be sensitive to how distributions during volatile markets can negatively impact overall portfolio values moving forward.

Third Party Investment Adviser Services

Employer Sponsored Retirement Plan Consulting Services:

As a Registered Investment Advisor (RIA) with significant years of experience in Portfolio Management utilizing individual securities, mutual funds/ETFs and separate account managers, we serve as an independent Third Party Investment Advisor (TPI) to plan sponsors, assisting them in the following four areas:

Investment Policy Statement Development

Fund Selection

Ongoing Fund Monitoring

Participant Education

Investment Policy Statement Development:

An IPS is a written document outlining the investment-related decision making process for a plan sponsor. Its purpose is to formally describe how investment decisions are related to a plan’s goals and objectives, as well as document the plans strategic vision for plan investment. A written IPS can also provide a framework for participant communication and education. The existence of an IPS provides evidence of a prudent investment decision-making process and, in doing so, can serve a risk-management role as the first line of defense against potential fiduciary liability.

Fund Selection:

Through our disciplined investment process, we develop an asset class matrix in order to provide the plan and its participants with a broad range of investment selections. We analyze funds for 1, 3 & 5 year returns, price/earnings ratios, Sharpe ratios, expense ratios, sector & portfolio composition, manager tenures, yield & duration of bonds, as well as the manager’s demonstrated adherence to stated investment objectives.

Ongoing Fund Monitoring:

We review and evaluate plan investment options on a semi-annual basis with the Plan Sponsor to determine continuing appropriateness of each investment option. Performance comparisons will be made against the representative performance universe and market indices for each investment.

Participant Education:

EIP, LLC offers semi-annual enrollment meetings to the plan participants. At these meetings, we provide participants with fund information as well as market and economic overviews to help them select appropriate investment options.

In addition, we may provide asset allocation models, taking into account such factors as retirement needs and risk tolerance to assist participants with making investment decisions.

Our Responsibility to Plan Sponsors:

In helping a Plan Sponsor fulfill its fiduciary duty, a TPI is committed to the following activities:

- Provide and update an investment policy for the plan.

- Make sure various asset classes are available within the plan for diversification purposes.

- Review/analyze fund choices within the plan on an on-going basis to see if changes are required.

- Meet with the Plan Sponsor at least annually to review overall plan status, discuss any possible changes, offer investment market feedback and answer any questions.

- Educate participants on the fund choices, asset allocation models, understanding the investment process and offer feedback on how current capital market expectations may impact the various funds.

- Act as an additional point person for service issues.

- Provide plan participant transition services to retirees and those leaving the plan.